Retail & Consumer

Retail & Consumer

Currys warns of £32m Budget tax hit as it says price rises 'inevitable'

Currys, the consumer electronics retailer, has joined the chorus of companies highlighting the detrimental financial impact of Labour's tax policies on its operations. In its half-yearly report covering up to 26 October 2024, the company today conveyed a forecasted hit of up to £32m due to recent tax policy adjustments. The breakdown of this figure includes a £9m burden from hikes in the National Living Wage, an additional £12m for the group’s National Insurance contributions, £2m from inflation-triggered rises in business rate taxes, and potentially £9m due to increased charges from suppliers, as reported by City AM. The management noted the intention to mitigate these cost pressures through various savings strategies such as "process improvement, automation, offshoring, outsourcing and overhead efficiencies," yet admitted some price increases "would be inevitable." For the six months ending 26 October, Currys reported a 52 per cent increase in adjusted earnings before interest and tax, which rose to £41m. Group free cash flow during this period reached £50m, reflecting an increase of £46m. On a like-for-like basis, overall revenue climbed two per cent, and the reporting period concluded with Currys boasting a net cash balance of £107m. CEO Alex Baldock expressed optimism about the retailer's trajectory, stating: "We’re very encouraged by our progress. Currys’ performance continues to strengthen, with profits and cashflow growing significantly, and the group’s balance sheet is strong." "We were well prepared for our Peak trading period, with healthy stock and market-beating, best-ever deals that show our unmatched importance to suppliers. We’re trading in line with expectations. One highlight is rising demand for AI laptops, where we enjoy over 75 per cent market share in the UK. AI is a trend with a lot further to run." "Looking ahead, we’re confident of continuing our progress, and expect to grow profits and cashflow as promised this year. This is despite new and unwelcome headwinds from UK government policy. These will add cost quickly and materially, depress investment and hiring, boost automation and offshoring, and make some price rises inevitable."

Retail & Consumer

Post Office anticipates record £1bn cash withdrawals in December, surpassing last year's festive season

The Post Office is forecasting a record-breaking number of personal cash withdrawals this month, expected to exceed £1bn. This prediction surpasses last year's record numbers during the festive shopping season, with December 2023 witnessing a total of £930m in cash withdrawals, as reported by City AM. The latest figures showed that a total of £916m in personal cash was withdrawn in November, marking a 1.6 per cent month-on-month decline from the previous month. Personal and business cash deposits also decreased to £1.45bn and £1.1bn respectively, down month-on-month by 2.5 per cent and seven per cent, reflecting the nationwide impact of Storm Bert. Ross Borkett, Post Office Banking Director, said this year's predictions follow trends indicating more people will "rely on cash in order to budget in the run-up to Christmas Day," He added: "We’re seeing indications that personal cash withdrawals will be greater in December than the previous year," Borkett also noted that following the disruption caused by Storm Bert last month, postmasters and their teams are ready to support small businesses who heavily rely on cash takings in the lead up to Christmas. The Post Office recorded its highest daily withdrawal for cash on 22 December 2023, with over £62m taken out over the counter just days before Christmas.

Retail & Consumer

Kellogg's UK operations sink to loss as sales rise past £1bn

Despite the growing popularity of its cereals and Pringles pushing sales beyond the £1bn mark, the combined UK operations of Kellogg’s have slipped into a loss. The company operates two separate entities in the UK from its Salford headquarters: Kellogg Marketing and Sales Company (UK) and Kellogg Company of Great Britain. Following the rebranding and splitting of the group's ultimate parent company last year, favourites such as Pringles, Pop-Tarts and Nutri-Grain now fall under the Kellanova brand, joining Frosties, Special K and Coco Pops. Newly-filed accounts with Companies House for 2023 show that Kellogg Marketing and Sales Company (UK) reported a turnover of £975.5m, an increase from £913.9m in 2022, as reported by City AM. Its pre-tax profit also rose from £24.1m to £28.5m over the same period. However, accounts for Kellogg Company of Great Britain reveal its turnover remained steady at £143m, but it shifted from a pre-tax profit of £13.6m to a loss of £61m. Despite the loss, Kellogg Company of Great Britain issued a dividend of £176.1m in the year. These accounts were filed with Companies House later than the 30 September deadline. This news follows Kellogg’s confirmation in May of plans to shut its Manchester-based factory, resulting in the loss of hundreds of jobs. The company announced it would close its Trafford Park factory towards the end of 2026, leading to around 360 job losses. The Wrexham factories and Salford headquarters of the company, which currently provide employment for approximately 1,000 individuals, remain unaffected by this development. The financial statements have been disclosed following the August announcement that Mars, the conglomerate known for brands such as M&M's, Snickers, and Skittles, agreed to acquire food behemoth Kellanova for $35.9bn (£27.9bn). Kellanova came into existence after Kellogg Co, established in 1906, divided into three separate entities. The transaction is anticipated to be finalised in the first half of the forthcoming year. In a statement endorsed by the board, Kellogg Marketing and Sales Company commented: "Growth in turnover was primarily driven by an increase in snacks net sales, led by sustained momentum in Pringles, driven by innovation, effective advertising and successful consumer promotions." "Cereal net sales were also up in the year, however, partially offset by unfavourable foreign currency." "Reported operating profit increased primarily due to overall higher sales, which was driven by both volume and price mix."

Retail & Consumer

Thames Water CEO defends bonuses of £770,000 for executives as firm posts £190m loss

Thames Water's chief executive, Chris Weston, has been compelled to justify the payment of £770,000 in bonuses to senior executives. This comes in light of the company registering a substantial £190 million loss and witnessing a concerning 40% hike in pollution incidents within its semiannual financial results, as reported by City AM. Weston insists that to draw and retain high-calibre personnel capable of revitalising the beleaguered utility, competitive compensation is necessary, despite Ofwat, the industry regulator, recently slamming the practice of charging customers for what it deemed "undeserved bonuses." "We need to attract talent to this company," Weston asserted. "If we don’t offer competitive packages, people will not come and work at Thames." These remarks synchronized with Thames Water revealing further grim financial figures, demonstrating the difficulties it faces as it desperately seeks vital funding to avert being nationalised. The losses of the water giant soared to an alarming £189 million in the first half of its fiscal year, exacerbated by penalties from Ofwat and soaring credit losses leading to it listing extraordinary charges of over £427 million for the six months ending 30 September. At the same time, its publicised debt levels climbed to an overwhelming nearly £16 billion Whilst the company hurriedly tries to gain approval for a potential £6.5 billion rescue plan composed of new capital, borrowing, and delayed debt maturities. Earlier this year, the company issued a warning that its liquidity would only last until April 2025. However, in November, it managed to secure a financial package from creditors, pending approval by the High Court, which is expected to deliver a judgement next week. Thames Water is also actively seeking new equity investors, following commitments made to Ofwat in August after the utility's credit rating took a hit, failing to meet the regulator's standards. On Tuesday, CEO Sarah Bentley, who joined Thames Water a few months ago after tenures at British Gas and Aggreko, reported "considerable interest" from potential equity investors.

Retail & Consumer

Vodafone hit with £120m lawsuit by 61 franchisees across UK

A collective of Vodafone franchisees throughout the UK have initiated a multi-million-pound lawsuit against the telecommunications behemoth, citing "bad faith" in business dealings. The legal claim, exceeding £120 million, was lodged at the Commercial Court of the High Court by IBB Law on behalf of 61 current and former Vodafone franchisees, as reported by City AM. The franchisees are accusing Vodafone of violating their duty of good faith and the stipulations of the Franchise Agreement, alleging that since July 2020, Vodafone has enforced unreasonable and capricious business decisions upon them. It has been noted that Vodafone recently withdrew from the British Franchise Association, an organisation dedicated to ethical franchising standards within the UK. The case against Vodafone includes several charges, among them is the accusation that franchisees were enticed into the programme with promises of unlimited earning potential, yet frequently faced commission structures that rendered their outlets unprofitable. Furthermore, the claimants argue that Vodafone unjustly profited from government-provided business rate relief during the Covid pandemic, funds that were meant to support the franchisees in times of economic hardship. One franchisee, Andrew Kerr from Northern Ireland, shared his experience: "It started off as a dream – and it’s ended up as a nightmare that haunts me every day. I felt I became Vodafone’s piggy bank. They pushed me to the point of financial ruin, and then took away my stores leaving me in crippling debt." A collective of franchisees independently sought legal guidance in October 2022 before forming a group, which has since initiated a legal claim through IBB Law. In response to these accusations, Vodafone has issued a denial. The telecommunications giant's choice for legal representation remains undisclosed. A spokesperson from Vodafone commented on the matter: "We are aware of the allegations and take them very seriously, and we are sorry to any franchisee who has had a difficult experience. While we have acknowledged challenges were faced by some franchisees, we strongly refute claims that Vodafone has ‘unjustly enriched’ itself at the expense of small businesses." "Our franchise model is a commercial relationship. We offer our franchise partners a large amount of cost-free support, but, as with any business, commercial success is not guaranteed. The majority of franchise partners are profitable and there is strong demand among our current franchisees to take on new stores". "We maintain that where issues have been raised, we have sought to rectify these and believe we have treated our franchisees fairly," they concluded.

Retail & Consumer

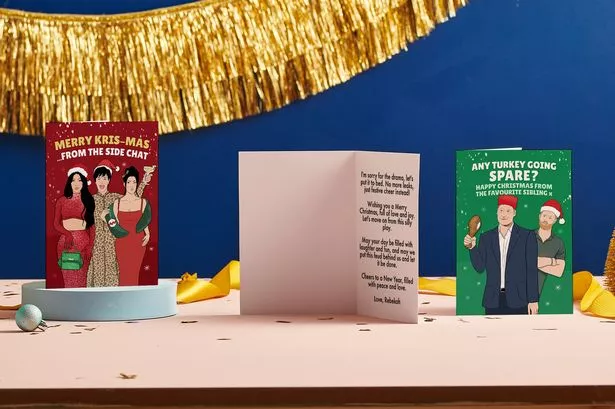

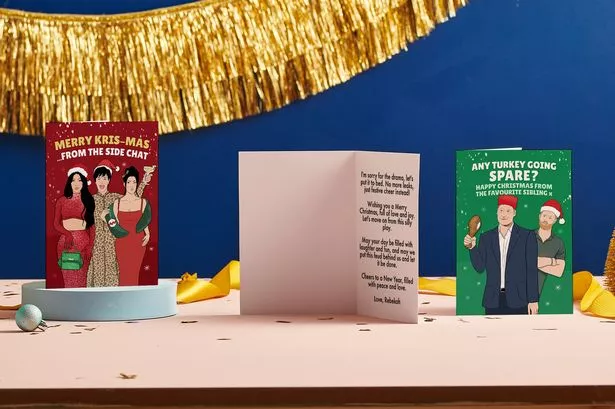

Moonpig shares tumble as card maker swings to £33m loss in first half of financial year

Moonpig has reported a loss in the first half of its financial year, as the personalised card maker's experiences business takes longer than expected to recover. The FTSE 250 company's share price fell by 12 per cent in early trading on Tuesday, despite shares remaining up by 57 per cent this year. Moonpig posted a pretax loss of £33.3m for the six months to 31 October, 2024, compared to a profit of £18.9m during the same period last year. The loss was attributed to a £56.7m goodwill impairment related to its experiences business, which partners with brands such as Slug and Lettuce, Hello Fresh and BrewDog, as reported by City AM. The firm cited "challenging trading conditions" and "trading conditions remain challenging with significant macroeconomic headwinds" impacting the unit, leading to an extended timeline for aligning experiences revenue growth with its full potential. A "transformation plan" for experiences is reportedly operationally complete and has realised over £1m in cost savings, including relocating its head office, outsourcing non-core functions and building a new leadership team. Basic earnings per share for Moonpig dropped to a negative 11.2p for the half year, compared to 4.1p a year earlier. On an adjusted basis, Moonpig’s profit came in nine per cent higher at £27.3m. The company has elevated its medium-term forecast for adjusted pre-tax earnings (EBITDA) margin to between 25 and 27 percent, up from the previous range of 25 to 26 percent, an uplift attributed to "continued growth of high-margin revenue streams such as plus subscription fees" Moonpig recorded a revenue of £158 million for the six months, marking an increase of 3.8 percent year-on-year. The postal card company, along with its Dutch counterpart Greetz which was acquired in 2018, registered approximately 200,000 new active customers during the half-year period, taking the total to 11.7 million. "Moonpig’s performance has been underpinned by robust growth in order volumes, powered by our multi-year investments in technology and innovation and the structural market shift to online," commented Nickyl Raithatha, Chief Executive of Moonpig.

Retail & Consumer

FirstGroup buys one of London's biggest bus operators in £90m deal

Transport heavyweight Firstgroup has made a strategic move into the London bus sector with the acquisition of one of the city's major operators. The Aberdeen-headquartered company, listed on the London Stock Exchange, announced on Tuesday that it had inked a £90m deal to acquire RATP London from its current owner, RATP Group, which is owned by the French state, as reported by City AM. The merger news, still pending approval from the French government and Transport for London (TfL), boosted Firstgroup's shares by over four percent in early trading. RATP London commands approximately 12 percent of the London bus market share. While TfL operates the majority of the bus network, other private firms such as Arriva and Go-Ahead Group also play significant roles. "This is a significant acquisition for the group that will diversify our portfolio and materially grow our earnings in the medium term," commented Graham Sutherland, CEO of Firstgroup. "It allows us to enter the London bus market at scale and will also bolster our credentials as we participate in future franchising opportunities across the UK," he further elaborated. Upon successful completion of the deal, Firstgroup will take over RATP’s 10 depots situated in Central and West London, as well as around 1,000 buses, a third of which are fully electric. RATP's workforce in London numbers 3,700, with over 80 percent being drivers. Last year, the company reported revenues of £271m. This announcement comes shortly after Firstgroup, part of the FTSE 250 index, revealed its acquisition of the open-access rail operator Grand Union Trains.

Retail & Consumer

Naked Wines slashes losses to £5.6m after 'solid' trading during peak period

The CEO of Naked Wines has stated that the company is "in a better position, both financially and strategically" after significantly reducing its losses in the first half of its financial year. The Norwich-based firm reported a pre-tax loss of £5.6m for the six months to 30 September, 2024, a decrease from the £9.7m loss it recorded for the same period in 2023, as reported by City AM. However, Naked Wines also saw its revenue drop from £132.3m to £112.3m. These half-year results follow the appointments of Rodrigo Maza as CEO in April and Dominic Neary as CFO in November. Maza commented: "Naked Wines is in a better position, both financially and strategically." "We now have robust financial foundations, and our members remain loyal and engaged." "Our strategic initiatives centred around customer acquisition and retention are generating learnings, and we are currently experiencing solid trading during the peak season period." "I am pleased to welcome Dominic as our new CFO. His experience in digital and international businesses have helped him quickly transition, and I look forward to working with him as we focus the business on cash, profitability and growth." Regarding its future prospects, Naked Wines noted that its early peak season trading has been "solid" and its liquidity and cash situation is "continuing to improve". It anticipates that its full-year performance will align with previous guidance. However, the company acknowledged that its US inventory, "whilst in line with previously communicated plans, remains overstocked". Naked Wines has stated it is "reviewing options" to free up capital from its inventory, a strategy aimed at enhancing cash flow over the next two years. However, this could lead to higher liquidation costs and potentially result in EBIT at the lower end of guidance.

Retail & Consumer

Procook shares dip as kitchenware retailer posts first-half losses

Kitchenware retailer Procook says it is “confident” in delivering growth after reporting an underlying operating loss of £1.8m for the first half of the year - up from £1.5m a year earlier. The Gloucestershire-based firm said it had “outperformed” the market over the 28 weeks ended October 13. Revenue over the period increased 7.5% to £28.3m, with underlying revenue up 4.2%. In the first eight weeks ending December 8, including Black Friday and the early part of Christmas trading, total revenue increased by +7.5%, with like-for-like revenue up 0.9%. The company opened four stores in the period, with plans in the pipeline for 10 new sites in total over the financial year. But shares in Procook fell 16% on the news of its increased first-half losses. Lee Tappenden, chief executive, said Procook had delivered a "strong performance" in the first half and had grown the company's customer base. “We have made good progress against our strategic priorities and continue to invest carefully in the areas that will support profitable growth in the medium term," he said. “We are pleased with trading results in the first half of the year. Whilst the important Q3 trading period had a subdued start in the early weeks coinciding with the Budget event, and a later Black Friday year on year, we are well positioned to take advantage of the improved momentum we are now experiencing, supported by our Christmas campaign, new product launches and strong inventory levels." Procook's expectations for the full-year remain unchanged. It added that it anticipated a "typical second half weighting" of revenue and profitability.

Retail & Consumer

Manchester Airport owner reports record passenger numbers - but warns of challenges ahead

Manchester Airports Group (MAG), which encompasses Manchester, London Stansted, and East Midlands airports, has flown to new heights with its pre-tax profit hitting £139.6m for the first half of their financial year ending on 30 September, 2024. This marks an increase from the previous £115.9m, buoyed by a 6.9% rise in traffic to 37.3m passengers, as reported by City AM. MAG's success story also includes its subsidiary travel services business CAVU contributing to a revenue surge to £768.5m from £705.6m. Notably, Manchester Airport celebrated a milestone, managing 17.8m passengers during this period and reaching an unprecedented annual total of 30 million travellers in September for the first time ever. In comparison to international counterparts such as La Guardia New York and Melbourne Airport Australia, Manchester Airport establishes its stature by entering their league. Meanwhile, London Stansted broke its own record for passenger numbers in a half-year with 16.7m visitors. MAG also witnessed its busiest day on record during October when it serviced 107,000 passengers within a single 24-hour timeframe. Additionally, East Midlands Airport saw a steady flow of 2.8m individuals over the six months. Despite facing increased taxes and operational costs, MAG CEO Ken O'Toole highlighted the group's achievement stating: "Across the summer, one in five UK air passengers chose to fly through a MAG airport for business, leisure, to study or visit friends and family." "This is testament to the strength of our route networks, our commitment to providing great choice and value to all our customers, and to always striving to deliver a positive passenger experience." "While our industry faces challenges both in the UK and globally, such as increasing taxation and rising costs linked to the push towards full decarbonisation of air travel, MAG’s strong financial and operational performance makes us well-placed to drive forward our investment programmes as we continue to grow."

Retail & Consumer

British Gas owner Centrica adds £300m to share buyback plan amid nuke boost

FTSE 100 stalwart Centrica has bolstered its share buyback initiative with an extra £300m, taking the total shares repurchased over the past two years to a staggering £1.5bn. In a trading update today, British Gas's parent company signalled that it foresees its full-year earnings and net cash for 2024 mirroring market expectations, as reported by City AM. Analysts project an adjusted earnings per share of 18.5p for Centrica in 2024, alongside an anticipated net cash position of £2.6bn. "The usual uncertainties remain for the balance of the year, including weather, commodity prices and asset performance," the energy firm highlighted. Since commencing in November 2022, Centrica's ambitious share buyback plan is on track to acquire roughly 20% of its stock by September 2025. Just last week, the company announced the extension of the operational life for four of its nuclear reactors until March 2027 – a year longer than previously planned. Nuclear output in the United Kingdom has been incrementally rising throughout 2024, registering a 2% increase since the year's start, as per analysts from Jefferies. In another sector insight, domestic gas consumption in UK households was six per cent higher than the three-year average from September to November. Coinciding, electricity and gas prices have surged by 20-30%. These updates surrounding its nuclear ventures contributed to a 12.7% rise in Centrica's share price over the past month. Despite this jump, the company's shares are still trailing seven per cent behind since January started.

Retail & Consumer

Harrods faces Christmas strike as hundreds of workers vote to walk out

Harrods, the renowned London department store reeling from the crisis, is gearing up for further turmoil as numerous employees have resolutely opted for strike action during the crucial Christmas period. Workers affiliated with the United Voices of the World (UVW) union are set to stage walkouts commencing at 8 pm on Friday, 20 December, continuing until Sunday, 22 December, and then resuming from 12 am on Boxing Day until 9.30 pm, as reported by City AM. The strike is expected to involve staff from retail, restaurant, kitchen, and cleaning departments. Harrods has maintained that UVW does not constitute a recognized union within the store, claiming any strikes would fail to have an effect. Despite this, UVW stated that their members "have had no option but to vote for strike yet again" following the refusal of Harrods' management "refuses to recognise or engage with their union for negotiations". Petros Elia, general secretary of United Voice of the World, remarked: "Contrary to what Harrods bosses say, we are still in a shameful period of their history." He continued, asserting that: "Their employees are still feeling the impact of a prevailing and deep-rooted toxic culture." Furthermore, he highlighted the disparities by stating: "Bosses at Harrods denying their dedicated workforce a Christmas bonuses and fair wages while lavishing obscene sums on its billionaire owners is proof." In a final rebuke, he added: "It’s outrageous that our members across retail, restaurant, kitchen and cleaning have had to vote to strike just to be heard." Lastly, he explained the workers' position: "The workers have been left with no choice but to strike because management refuses to engage with them or even recognise their union." "We call on Harrods to come to the table and negotiate so the store can remain open for Christmas shopping and continue to serve all Londoners this festive season." The strike action comes in the wake of ongoing revelations about former Harrods’ owner Mohamed Al Fayed. Al Fayed, who is accused of sexual offences against numerous women but was never charged during his lifetime, passed away last year at the age of 94.

Retail & Consumer

British American Tobacco says smokeless products gamble is paying off

British American Tobacco (BAT), the owner of Pall Mall and Lucky Strike, has reported strong results from its shift to smokeless products as it awaits further updates on its legal action in Canada. The company confirmed in a trading update that it would deliver full-year results in line with guidance, as trading in the second half had grown in line with expectations, as reported by City AM. BAT is currently awaiting the conclusion of negotiations over a five-year legal process involving its subsidiary Imperial Tobacco Canada Limited obtaining creditor protection under the Canadian Companies’ Creditors Arrangement Act. The cigarette manufacturer's full-year results for 2024 are due in February, where it said there would be "more clarity" on the ongoing Canadian litigation. Shares in BAT hit a two-high at the end of November as investors started to buy into the group’s shift away from traditional tobacco products such as cigarettes. "[The results] have seen the firm use cost cuts and price increases so it can offset falling stick volumes and still generate fat profits and copious cash flow," said Dannis Hewson, AJ Bell’s head of financial analysis. The company has been increasingly pivoting towards vapes and the oral market in recent years in an attempt to pull away from the slowly dwindling number of smokers. British American Tobacco's chief executive, Tadeu Marroco, stated: "We continue to make progress towards our ambition of becoming a predominantly smokeless business by 2035." He added: "We are making further progress increasing profitability across new categories, and I am particularly pleased with the improvements in heated products and modern oral."

Retail & Consumer

Tui profit soars but shares slide as holiday giant warns growth will slow

Tui, Europe's largest tour operator, has reported a significant increase in profit for the last financial year, with underlying earnings before interest and taxation (EBIT) rising by 33% to €1.3bn, up from the previous year's €977m. This comes as more than 20 million customers chose to travel with the package holiday provider, as reported by City AM. Revenue also saw an increase, climbing 12% to reach €23.2bn. Tui's CEO, Sebastian Ebel, praised the company's performance, describing it as a "very good year" and stating that the firm is "well positioned" for future success. Despite this, shares in the company fell by over 5% in early trading due to slower growth forecasts for the upcoming year. The company's guidance for full-year revenue growth currently stands at 5-10%, with underlying EBIT expected to grow by 7-10%. Tui, which recently switched its London listing for Frankfurt, also reported an increase in prices throughout the year, with costs for winter and next summer predicted to rise by 5% and 3% respectively. Aarin Chiekrie, an equity analyst at Hargreaves Lansdown, commented: "Consumers continue to prioritise travel, meaning more customers have been willing to pay higher prices to enjoy a break away from everyday life." Chiekrie also highlighted the diverse nature of Tui's business, which includes an airline, cruise ships, hotels and resorts, as a factor in its resilience to wider trends.

Retail & Consumer

Poundland owner Pepco reports £458.7m loss amid declining UK sales

Pepco, the discount retail giant and owner of Poundland, has reported a loss exceeding £450m following a weak performance from its UK subsidiary, Poundland. The European group revealed a pre-tax loss of €554m (£458.7m) for the year ending 30 September 2024, a stark contrast to the profit of €159m (£131.6m) it made in the previous year. This loss was largely due to a non-cash impairment charge of €775m (£641.8m) booked for Poundland after a significant drop in performance. The UK brand's like-for-like sales fell by 3.6% over the year, and its profit outlook weakened amid rising competition and costs, as reported by City AM. Non-executive chairman Andy Bond expressed renewed confidence in the future, stating: "I am proud of the progress we have made over the last 12 months." He added: "We grew underlying EBITDA by a quarter to €944m across the group, ahead of expectations, with a strong recovery in gross margin of almost 400 basis points, driven by the performance of our core Pepco brand." He concluded by outlining the objectives achieved during the year, which included rebuilding Pepco’s profitability in its core Central and Eastern European (CEE) market, recovering gross margin, adopting a more disciplined approach to investment, reviewing underperforming areas of the business, and delivering stronger cash generation. "We have delivered on these objectives, but there remains more to achieve." "As a result of renewed confidence in our future, we are announcing an inaugural full year dividend for the Group." "I am pleased to have handed the reins of the business over to our new CEO, Stephan Borchert, effective 1 October, 2024." "Stephan brings a wealth of experience in retail businesses internationally alongside a strong track record of delivering results, and I look forward to working with him as he leads this business to future success." Despite the pre-tax loss, Pepco Group pointed to its record underlying EBITDA (earnings before interest, taxes, depreciation and amortisation) for the year which rose by 25.2 per cent to €944m. It also announced an inaugural full-year dividend "reflecting the group’s free cash generation, strong balance sheet and increasing confidence in its outlook". Chief executive Stephan Borchert added: "Pepco Group has very attractive, market-leading retail businesses, providing great product range, value and convenience to over 60m customers each month across Europe. ". "Within the group, I see the Pepco concept itself as our key engine for future strategic and financial growth, particularly in Pepco’s CEE heartland." "Pepco generates the vast majority of the group’s earnings and our highest returns on capital – we plan to further build on that strong base." "In the year ahead, our core focus at Pepco will be to deliver improved like-for-like revenues." "Pepco’s like-for-like performance has been positive since the start of September – an encouraging start." "At Poundland, recent performance has been very challenging, impacted by declines in clothing and general merchandise following the transition to Pepco-sourced product ranges at the start of the year." "We are taking swift action to get Poundland performance back on track, focusing on a return to Poundland’s strengths. " "We will also closely evaluate Poundland’s overall competitive positioning and requirements for future success as an FMCG-led format." "We will provide further updates on Poundland during the first half of 2025. " "I am excited to join Pepco Group at this important stage in its evolution toward a company focused on targeted new-store expansion, higher capital returns, and growing earnings and free cash flow."

Retail & Consumer

Amazon buys rights to Warhammer 40,000 games

Amazon is poised to launch a series of films and television shows based on the popular game Warhammer 40,000 from Games Workshop. In a stock exchange announcement this morning, Games Workshop confirmed it had established "creative guidelines" and secured a deal with Amazon to bring the Warhammer 40,000 universe to life in film and TV adaptations, along with associated merchandising rights for any Amazon-produced content, as reported by City AM. "This update was largely expected, but it is the important final step in bringing Warhammer to a global audience," commented Peel Hunt analysts Charles Hall and Andrew Ford. Set to join the FTSE 100 later this month, Games Workshop boasts an extensive library of intellectual property that has only recently started to be exploited commercially. According to the company's latest financial results, licensing revenue soared by 150% year-on-year to £30m, significantly surpassing analyst predictions and enhancing profitability. "This push into licensing is a big part of the company’s future growth strategy," said Susannah Streeter, head of money and markets at Hargreaves Lansdown, in a discussion with City AM. Today's agreement grants Amazon exclusive rights to any Warhammer 40,000 film or TV project, with the option to license similar rights in the Warhammer fantasy realm following the debut of an initial Warhammer 40,000 screen adaptation.