NatWest shares surge as Q3 profits climb 26%, driven by robust lending growth

Shares in Natwest Group saw a significant surge today after announcing its third quarter profit had jumped by 26%, propelled by a robust performance underpinned by its lending operations.

For the third quarter of 2024, the banking giant reported an operating pre-tax profit of £1.7bn, marking a substantial increase on the £1.3bn posted in the same period last year, as reported by City AM.

Investors greeted the news with optimism, as evidenced by Natwest's share price leaping nearly five per cent at market opening.

The 'Big Four' bank enjoyed an increase in total income excluding notable items to £3.77bn, up by over five per cent from the preceding quarter, largely due to lending expansion, boosted deposits and an improved net interest margin (NIM).

Other operating expenses were down £144m in comparison to the previous quarter but stood £38m higher, discounting charges linked to a retail share offering, than during the corresponding quarter in 2023.

Impairment losses recorded by the bank amounted to £245m, with loan defaults "remaining at low levels" across the portfolio.

In terms of lending activity, net loans extended to customers, not counting central items, climbed £8.4bn, supported by a £2.3bn purchase of Metro Bank's mortgage portfolio complemented by growth across all segments of the bank's business.

Significantly, mortgage balances swelled by £1.4bn throughout the quarter. Likewise, customer deposits, taking out central items, experienced a £2.2bn influx, with savings accruing across each of the business's units.

The banking group has expressed a commitment to adapt to changing economic landscapes by keeping a close watch on market shifts and revising its internal forecasts as necessary.

Natwest has set its sights on achieving a return on tangible equity greater than 15% by 2024, with anticipated income, excluding notable items, expected to reach around £14.4bn.

The group anticipates stable operating costs for the year, setting aside litigation and conduct-related expenses, although it expects some increases due to bank levies and the costs associated with a retail share offering.

Paul Thwaite, the Chief Executive, commented on the company's performance: "Throughout the third quarter of 2024, we have grown our lending, helping customers to buy or remortgage their homes or to start and grow their businesses."

He further noted the company's strong position, saying, "With customer activity increasing, defaults remaining low and optimism amongst businesses and consumers, we are well placed to succeed with our customers and for our shareholders in the months and years ahead,".

Meanwhile, Matt Britzman, Senior Equity Analyst at Hargreaves Lansdown, remarked, "NatWest marks the third major UK bank to report better than expected results this week, but this time it's not driven by impairments."

Recommend

Professional Services

UK motor finance sector faces potential crisis after court ruling on hidden commissions

A brewing storm in the motor finance industry is bracing itself for a potential crisis, with lenders facing a flood of compensation claims following a recent court ruling. Lars Mucklejohn examines whether the sector is on the cusp of a disaster akin to the PPI scandal. A London court's decision on "secret" car loan commissions has sent shockwaves through the industry, prompting major lenders to halt new business, overhaul their systems, and seek urgent talks with the government, as reported by City AM. The Court of Appeal's ruling, handed down last Friday, determined that brokers cannot lawfully receive commissions from lenders without obtaining customers' fully informed consent. This development has increased the likelihood of the Financial Conduct Authority (FCA) introducing a redress scheme for lenders as part of its review into discretionary commission arrangements (DCAs), potentially exposing banks to billions in additional compensation costs. In response, Lloyds Banking Group has eliminated commission payments for new loans at its motor finance arm, Black Horse, the UK's largest auto lender. On Tuesday, William Chalmers, the group's chief financial officer, held an emergency call with analysts and investors to discuss the court ruling's implications, according to City AM. However, he did not provide details on whether Lloyds would set aside additional provisions beyond the £450m allocated in February to cover potential costs. However, Chalmers did mention that the factors influencing the bank's provisioning model have broadened beyond just estimating the impact of the FCA's review. Since the ruling, Lloyds' share price has plummeted by 14 per cent. RBC Capital Markets predicts that in a worst-case scenario, Lloyds could suffer a £3.9bn blow to its profits. Earlier this year, Close Brothers, deemed the bank most vulnerable to the FCA's investigation in relative terms, made arrangements to strengthen its finances by £400m and has since offloaded its wealth division for £200m. However, the circumstances have deteriorated significantly for the 146 year old merchant bank. Close Brothers, which participated in last week's test case, has suspended new car loans following the ruling. Its share price, already severely impacted earlier this year, has plunged 37 per cent since last Friday and is now at a thirty-year low. RBC has projected a worst-case scenario where Close Brothers suffers a £387m loss from compensation, interest, and administrative costs. This figure surpasses the company's current market capitalisation of £343m. In other news, Santander UK has postponed the release of its complete third-quarter results to assess the ruling. RBC anticipates a downside impact of £1.8bn. Several smaller auto lenders have also halted loans, including Zopa, Secure Trust Bank, MotoNovo, Mann Island, V12, and Northridge. Analysts are flagging concerns that the recent legal developments could see several companies exiting the market as a result of judges essentially overturning prior guidance from the Financial Conduct Authority (FCA). Benjamin Toms from RBC remarked to City AM, "Banks will quickly adapt their contracts and processes to comply with the new rules," but warned, "However, in the medium term, some lenders will decide that lending in this sector is no longer for them." Noticeably, firms like Secure Trust, which have ceased lending operations, had previously indicated they were not majorly affected by the FCA's investigations. An industry executive confided in City AM about previous scepticism towards analyst warnings that financial institutions might face billions in potential liabilities for compensation, especially considering that the FCA had pointed out that only £165 million in additional fees had been levied upon consumers annually by Default Charges Agreements (DCAs) between 2007 and 2021a period now under FCA scrutiny. The ban on DCAs, which were at one time a standard feature in around three-quarters of car loan agreements, has prompted a surge in historical complaints against the banking sector. Navigating these legacy issues, claim management companies are capitalising on the situation, vying for consumer compensation. The aftermath of the FCA commencing its investigation was stark: within just four months, the Financial Ombudsman Service, which adjudicates disputes between consumers and finance entities, was inundated with 20,000 complaints concerning car finance. An executive from a motor finance company disclosed to City AM that following Martin Lewis citing their bank on television as one not using Debt Collection Agencies (DCAs), the firm was inundated with over 2,000 complaints despite the endorsement. Urgent consultations were initiated on Tuesday by Treasury ministers with Financial Conduct Authority (FCA) executives and members of the Finance and Leasing Association (FLA), the body representing car loan providers, centring around the recent court decision. The FLA is now pressing the regulator for an extension of the temporary respite on the standard two-month period within which firms must address DCA grievances, a cessation that's currently operative until December 2025. In a statement on Tuesday, FCA chief Nikhil Rathi revealed the watchdog would think over this recommendation. A spokesperson from the Treasury informed City AM: "The Treasury is working closely with the regulators and industry to understand the impact of this judgement." Subsequent to the judges' ruling that lenders are obliged to disclose to consumers any dealer remunerations including not only bonuses but also flat fees there's speculation by legal experts that the ramifications of this verdict might ripple out to encompass consumer finance commissions more broadly. Toms remarked: "Three examples of the many questions which have been left outstanding include: Does this decision extend beyond motor finance? Which years are now in scope? And do all commissions paid need to be returned to customers? ". In the wake of last week's court ruling, it is anticipated that the Financial Conduct Authority (FCA) may further delay its progress on the review initially scheduled for September, then deferred to May 2025 this past July. This follows announcements by Close Brothers and First Rand, a South African bank, that they intend to challenge the recent judgement in the Supreme Court. With the case's commercial sensitivity in mind, the court is expected to fast-track the appeal, yet a swift resolution appears doubtful, putting the FCA's ability to factor in the outcome into its May update in jeopardy. Furthermore, as banks ready their annual financial disclosures slated for February, calculating the full ramifications remains a challenge. RBC analysts project that as a result, the regulatory body will likely postpone its announcement until summer. The FCA has yet to comment on these predictions. The stalling of the motor finance sector could have severe repercussions on the UK economy by disrupting the automotive market and impacting sales. Last year saw lenders issue car loans amounting to £16.9bn, with 80% to 90% of new cars being bought on credit. "Ultimately this will lead to lower supply of motor finance products, which will inevitably result in a higher cost of motor finance for the customer," Toms explained. A potential redress scheme might bear the weighty distinction of being the most significant for UK banks since the notorious payment protection insurance (PPI) scandal. In that instance, customers were compensated over £38bn between 2011 and 2019 due to the mis-selling of insurance policies. Analysts have estimated that banks' combined exposure has reached approximately £16bn to date. This figure does not account for the finance divisions of motor companies, which are responsible for the majority of auto lending in the UK.

Professional Services

WorkNest expands with Wirehouse acquisition for undisclosed sum

Leading North West employment consultancy WorkNest has swooped for a Warrington business in an undisclosed deal. Chester based WorkNest, an employment law, HR, and health and safety specialist, has acquired Wirehouse Employer Services in a deal which will extend its new owner’s national client base while broadening its team of specialists and qualified consultants. Worknest is a division of The GRC Group, an Inflexion-backed leader in governance, risk and compliance software and tech-enabled services, while Wirehouse provides retained HR, employment law and health and safety consulting and advice services to SMEs. Founded in 2010 and based in Warrington, Wirehouse offers services closely matched to WorkNest’s HR and health and safety solutions, assisting businesses across a range of sectors throughout the UK, providing advice and support on sector-specific egislation. The deal marks the third acquisition for The GRC Group this year and the first acquisition in the employment law, HR and health and safety space this year. It follows the group’s acquisitions of cyber security businesses Bulletproof Cyber, in May, and Pentest People, last month. Ifti Ahmed, CEO at WorkNest, said: “We pride ourselves on working closely with employers nationwide to provide high-quality, pragmatic, and professional advice and support. This acquisition enhances WorkNest’s scale in our core SME market and plays to our strength of integrating complementary businesses in our field. “I’m very pleased to welcome our new colleagues who share the same commitment to delivering fantastic client service. Wirehouse’s long track record of profitable growth is a testament to its leadership over 14 years, which has built a strong and trusted reputation in our sector.” Sue Malley, managing director at Wirehouse, said: “We’re extremely excited to join up with the WorkNest team. Given the compatibility of the businesses, we can see the opportunity to enhance our offer and deliver significant benefits to our valued clients. With the expanded scale and range of services provided by the wider group, we look forward to an exciting period of strategic development and growth for our business.

Professional Services

Former JP Morgan man leads acquisition of £3.5m stake in Atom Bank

A former JP Morgan executive is at the helm of bid to buy a stake in North East-based challenger bank Atom, it has been reported. Sanjiv Somani, who led the US giant's digitally only Chase UK bank until last year, is leading investment firm Lexham Partners, which was set up last year by venture capitalist Dominic Perks. The firm is said to be negotiating the purchase of a stakeholding from existing shareholders. The move, which was first reported by Sky News, means Mr Somani - who also led digital wealth manager Nutmeg after its acquisition by JP Morgan in 2021 - will manage the stake in Atom. Lexham is reported to be looking at £3.5m worth of stock at 40-per-share, valuing Atom at £400m. It comes a year after Atom raised £100m in new equity capital from long-term shareholders BBVA, Toscafund and Infinity Investment Partners - money which was used to boost balance sheet growth. At the time, Atom said the funding round formed part of a long term strategy to "deliver a liquidity event in the future". with CEO Mark Mullen saying the bank was working to make itself a "credible candidate for IPO". In June Atom published results for the year to the end of March 2024, in which it said it had generated a 600% increase in operating profit to £27m. Net interest income was boosted 31% to £99.5m thanks to strong loan book growth of 39% to £4.1bn on the back of growth in residential mortgage balances to £3.2bn. The results were said to be the best since the bank's launch in 2013, and also saw operating income rise to £88.3m from £65.8m, while the pre-tax profit of £6.7m was compared with the previous year's pre-tax loss of £10.1m. The bank, which has switched to a four day working week, also grew its headcount, surpassing 500 staff. In May, Atom appointed former Virgin Money chief financial officer Lee Rochford as chairman. Mr Rochford was instrumental in Virgin Money's stock market flotation in 2014. At the time of its results, Mr Mullen said: "This has been our best year yet at Atom bank. We have achieved profitability across all measures, grown our loan book significantly, maintained robust credit quality, avoided fraud losses altogether, kept our costs tightly controlled and enhanced our already industry leading customer experience metrics. “We begin the new year with tailwinds in the form of strong asset pipelines, excellent technology, a highly engaged team, supportive investors and an enviable reputation with customers. Beyond the confines of banking, we have exciting plans to further reduce our impact on the planet and to create even more opportunities in our local community.

Professional Services

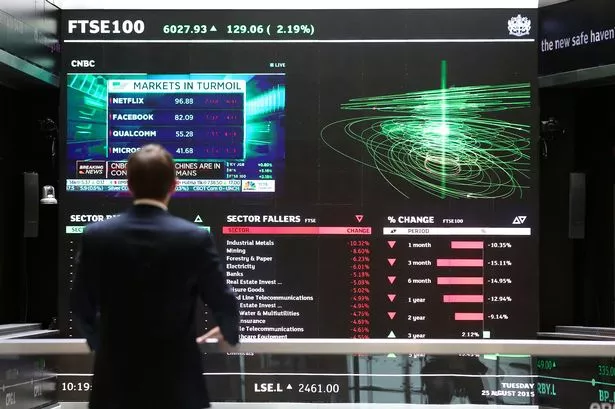

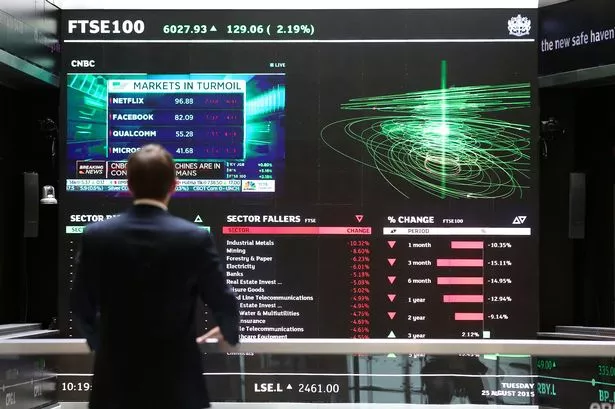

FTSE 100 climbs sharply as US-focused UK firms benefit from Trump's presidency

The FTSE 100 experienced a significant rise at the start of trading today, while sterling took a hit as traders evaluated the potential impact of Donald Trump's presidency on the global economy and the UK. London's leading index saw an increase of over 1.4 per cent in early trading, driven by a nearly six per cent surge for US-focused equipment rental company Ashtead, along with substantial increases for Barclays and IHG, as reported by City AM. Ashtead, which generates approximately 85 per cent of its revenue from the US, has reportedly contemplated shifting its listing to New York within the past year. "Trump did not mention tariffs in his victory speech, and this is why we are seeing UK firms with US exposure rallying on Wednesday," commented Kathleen Brooks, research director at XTB. "A win for Trump is also seen as being good for the US economy, which is also boosting big UK companies who export to the US." FTSE 100 constituent Rolls Royce, a major exporter to the US, also saw a rise of around 4.5 per cent. London's markets have greater exposure to the American economy than many European counterparts, with roughly 28 per cent of revenues generated in the US, according to Bloomberg Intelligence analyst Kaidi Meng. Pharmaceutical and consumer-related companies are "susceptible to drug re-pricing risks and tariff, " Meng stated today. "While a potential 10 per cent tariff [...] brings risk to UK exports, other possible impacts include drug-price renegotiation for health-care industry, wage increase and reflation risks from reshoring US manufacturing, higher defence spending and renewable energy disincentivizing," she added. The FTSE 250, more exposed to the domestic economy, also saw an increase of around two per cent. Pershing Square Holdings, led by billionaire New York hedge fund chief Bill Ackman, also experienced a near four per cent rise before 8:30am. Ackman has been a prominent business supporter of a Trump presidency. However, the pound has seen a significant drop to 1.28 against the dollar as investors flock to so-called Trump trades.

Professional Services

Scunthorpe accounting firm Jackson Stapleton secures £150,000 funding deal

A Scunthorpe accountancy is set to take its growth to the next level on the back of a £150,000 funding package. Jackson Stapleton Accountants, which was established in 2017, has secured the funds from the Midlands Engine Investment Fund II, following assistance from fund manager for the East and South East Midlands, Maven Capital Partners. The business expanded its UK footprint in 2021 through the acquisition of a Lincoln-based office, previously known as Fawcett & Co. Now the new funding will allow the business to grow further and develop its client base, through the addition of a practice in Retford. Mark Jackson-Stapleton, managing director at Jackson Stapleton, said: “In September 2024, we proudly acquired our third office in Retford, formerly known as Mill Accountancy. This acquisition marks another significant milestone in our journey, as we remain committed to surpassing past successes and setting new standards of excellence in accounting services. "We believe that by continually investing in advanced technology and the ongoing development of our staff, we can offer more efficient and tailored services to meet the evolving needs of our clients. I would like to extend my sincere thanks to Richard and the Maven team for their excellent support in securing the necessary finance for this acquisition. Their expertise and dedication have been invaluable to our continued growth.” Richard Altoft, investment director at Maven, said: “Maven are excited to be supporting Jackson Stapleton through the Midlands Engine Investment Fund II as it expands its business. The business has a highly experienced management team, capable of growing the business and taking its service offering to the next level. “ David Tindall, at British Business Bank, said: “It is great to see finance from the Midlands Engine Investment Fund II being used by Jackson Stapleton Accountants to build on its success and explore new opportunities for growth and expansion while creating a positive impact in the local economy in the Midlands.”

Professional Services

UK's largest wealth manager St James's Place to embrace crypto after fund management overhaul

St James's Place's chief investment officer has revealed to City AM that there will be a continued significant reshuffling of who manages some of the UK's largest funds. In December, the country's leading wealth manager withdrew £2bn from Somerset Capital Management, a firm founded by Jacob Rees-Mogg, leading to its immediate closure as the mandate accounted for about two-thirds of its assets, as reported by City AM. This week, Gloucestershire-based St James's Place made a similar move, dropping Impax Asset Management and two others as managers of a struggling £9.9bn fund, causing the smaller asset manager's stock price to drop six per cent over the past two days. Justin Onuekwusi, who took on the role of chief investment officer a year ago, stated that investors should anticipate "a number of changes" in terms of which asset managers control the substantial amount of money in its coffers. "But I think it's important to take a step back as well and say the proposition always has to evolve. It's not that I've come in and now it's a big bang," added Onuekwusi. This move could have serious implications for the entire UK financial industry, as asset managers vie to manage money for the wealth giant. Over the past year, St James's Place has had to evolve more than most asset managers, following accusations that it was 'stuck in the past' and the introduction of consumer duty. The Financial Conduct Authority's Consumer Duty, introduced last year, mandates all financial services to "put their customers' needs first". Despite this, St James's Place has faced challenges due to high charges, exit costs, and non-transparent fee bundling, prompting a need for reform to maintain its status as the industry's leading wealth manager. Savers have struggled to determine if they're getting value for money from St James's Place because the bundled fees make it difficult to compare with other similar funds. "From an investment perspective, we obviously really welcome disaggregation, because it means that we can be compared like-for-like with other managers," Onuekwusi remarked to City AM. Onuekwusi, when questioned about whether St James's Place would apply the separated fees retroactively to allow analysts to assess fund performance accurately, stated that discussions are ongoing. "I think it would make sense to backdate for people to understand the journey they would have been on from a fund perspective," he added. Onuekwusi, who began his role a year ago, noted part of his job was to innovate the firm's offerings to clients. He emphasised that while there is a shift towards more cost-effective investments, it doesn't solely mean moving into index funds. The Chief Investment Officer (CIO) of a leading wealth management firm has highlighted the evolving landscape of investment strategies, noting: "As the market has innovated, now we have different types of index strategies, different types of low cost strategies, whether quant, fully indexed, or others." He also emphasised the importance of emerging asset classes, stating: "In 2035, you can't guarantee much in investment, but you will have new asset classes." The CIO's remarks reflect a forward-thinking approach, particularly as he acknowledged the potential of crypto, digital assets, tokenisation, and private equity sectors that might be avoided by firms with an outdated 'cultural DNA'. "As the largest wealth manager in the UK, we've got a responsibility, I think, to be on top of that," Onuekwusi remarked. However, this push for innovation is at odds with the company's goal of becoming a lower-fee St James's Place, given that new asset classes like private equity are known for their higher costs. "We are very conscious that the newer asset classes tend to be more expensive, so we've been very cautious about dipping our toe in the water there," he explained. Onuekwusi further commented on the integration of these asset classes into the company's offerings: "The thought is, do we want them in our centralised investment proposition, or do we want them in more bespoke types of propositions? That's something we are clearly aware of,". Yet another challenge is the £500m in cost-cutting measures that St James's Place has committed to over the coming years, which could conflict with the resource demands of innovation.

Professional Services

Shawbrook Bank's loan and deposit books surpass £15bn amid robust demand in real estate

Shawbrook Bank has announced that its loan and deposit books have surpassed £15bn for the first time, following a surge in lending demand during the first nine months of the year. In today's trading update covering the first three quarters, the retail lender reported an 18 per cent annualised increase in its loan book to £15.1bn, up from £13.3bn the previous year, propelled by "strong net lending volumes across our core specialist real estate and SME markets", as reported by City AM. The bank's deposit book also experienced significant growth, expanding by 16 per cent to over £15.2bn, compared to £13.6bn last year. "Demand for the premium experience, flexibility and certainty we offer across our specialist lending markets remains robust, with both our loan and deposit books exceeding £15bn for the first time," Marcelino Castrillo, Shawbrook Bank's chief executive, commented. "We have maintained our focus on re-weighting our lending mix while leveraging our agility in the deposit market, contributing to a stronger underlying return on tangible equity for Q3." "Investment in the continuous evolution of our proposition to stay ahead of customer needs, expectations and trends remains our strategic focus." However, the bank did note an uptick in the number of clients in arrears, rising to 2.8 per cent from 2.3 per cent, a figure which the firm stated remains within its credit risk appetite. "As we look ahead, we continue to see promising opportunities for expansion and value creation across our core markets, including SME and Real Estate," Marcelino further added.

Professional Services

The Bank of England's latest interest rate decision is a sign of things to come

At a notably bustling period for economic policy, the Bank of England has made a key interest rate decision. Just over one week ago, Chancellor Rachel Reeves put forth the new government's foremost Budget, hinting at a shift in fiscal strategy, as reported by City AM. Compounding this, Donald Trump's ascension to the US presidency was verified, with potential ramifications for global trade policies due to his protectionist tendencies. In this context, Bank policymakers faced numerous concerns. Nonetheless, the vote among rate-setters concluded with an eight to one majority in favour of reducing interest rates to 4.75 percent. To put this into perspective, August saw a more divided outcome at five to four when the Bank first implemented a rate cut. The minutes from the Bank imply little anxiety regarding inflation trends. The explanation appears straightforward: inflation has been subsiding more swiftly than anticipated by the officials. Specifically, inflation plummeted to its lowest since April 2021 in September. Services inflation, a key indicator for the Bank, also recorded lower than projected figures. "The disinflation process not only continues but actually has been faster than we expected, and that's good and encouraging," remarked Governor Andrew Bailey at a press briefing post-announcement. Bailey repeatedly emphasized a "gradual" pace in interest rate reduction, echoing his sentiments from September. Thus, the question arises amidst these developments, what has fundamentally altered? The Bank of England's recent forecasts, released alongside the rate decision, indicate that the Budget's measures will drive up inflation. According to their central projection, the headline rate will be 0.5 percentage points higher than it would have been otherwise, peaking at 2.75 per cent in the middle of next year. Economic growth is expected to be around 0.75 per cent higher, suggesting the economy will operate at full capacity for the next couple of years. These significant adjustments to the Bank's forecasts suggest reduced leeway for aggressive rate cuts. However, opinions on the magnitude of this change vary, depending on initial expectations regarding the likelihood of aggressive rate cuts. Governor Andrew Bailey appeared sceptical, stating: "I don't think that it's sensible to conclude that the path of interest rates will be particularly different," and highlighted that inflation is projected to return to the two per cent target within the forecast period. Yet, the actual impact could exceed the Bank of England's central projection. The Bank anticipates only a "small decrease in potential supply" and a "small upward impact on inflation", contingent on how businesses respond to the tax increase. Firms have several options: they might absorb the additional costs, pass them on to consumers, restrict wage increases, or reduce employment. Bank of England officials have highlighted the uncertain implications of various factors on inflation, stressing the difficulty in making precise predictions at this stage. Governor Andrew Bailey has suggested a cautious, gradual approach to interest rate adjustments, allowing the Bank "time to assess the impact" of recent national insurance hikes. Undoubtedly, the election of Donald Trump as US President poses additional potential risks to the inflation outlook due to his threats to impose significant tariffs on foreign imports. Such measures, if reciprocated by other nations, could inflate prices and dampen economic growth. Estimates from the National Institute of Economic and Social Research (NIESR) indicate that UK inflation rates could rise by three to four percentage points, with interest rates potentially climbing by two to three points as a consequence of these tariffs. While the Bank did not deliberate over the specific effects of such tariffs, Governor Bailey appeared cautious about conjecturing on Trumps likely policies, stating it was "not useful or wise" to speculate.

Professional Services

Standard Chartered to double down on wealth management after tripling profit

Standard Chartered has announced plans to double its investment in its wealth management division, following a third-quarter profit that exceeded expectations and enhanced plans for shareholder returns. The FTSE 100 lender, which primarily operates in emerging markets, posted a pretax profit of $1.72bn (£1.3bn) from July to September, surpassing analysts' predictions of $1.49bn (£1.1bn), as reported by City AM. This profit is almost triple the $633m (£487m) reported during the same period last year when the bank incurred nearly $1bn (£800m) in impairment charges due to its exposure to China's sluggish economy. As it continues with a cost-cutting plan announced in February, Standard Chartered has increased key performance targets. The bank anticipates its income will grow towards 10 per cent by 2024, up from a previous estimate of above seven per cent. It now aims to return at least $8bn (£6.1bn) to shareholders between 2024 and 2026, an increase from $5bn (£3.8bn). Although headquartered in London, Standard Chartered generates almost all of its revenue in Asia, the Middle East, and Africa, with significant hubs in Hong Kong and Singapore. As part of its revised strategy, the bank intends to generate more fee income from wealth management. It revealed on Wednesday that it would double investment in its wealth business and spend $1.5bn (£1.2bn) over five years on relationship managers and investment advisers. Standard Chartered plans to fund its operations by reducing its mass retail business, mirroring the strategy of competitor HSBC, which has withdrawn from retail markets in the US and France to concentrate on more lucrative sectors. "We are exploring the opportunity to sell all or part of a small number of businesses where the strategic rationale is not sufficiently compelling," stated Standard Chartered, anticipating these actions to occur over the next 18 to 24 months. Shares in Standard Chartered rose by 3.7 per cent in early London trading and by three per cent in Hong Kong. The bank's focus on wealth management proved successful in the third quarter, with income from wealth solutions surging 32 per cent year-on-year to $694m ($533m), making it the fastest-growing division among the bank's main businesses. In February, the bank outlined plans to boost its return on tangible equity (RoTE), a crucial profitability metric for banks, from 10 per cent to 12 per cent by 2026. On Wednesday, it increased this 2026 RoTE target to "approaching 13 per cent". The share price of Standard Chartered has struggled in recent years, with CEO Bill Winters labelling it as "crap" in February. His tenure has seen the bank eliminate thousands of jobs in an effort to enhance investor returns. These turnaround efforts have resulted in a 37 per cent increase in the stock this year. It is currently trading just below its level when Winters took over as CEO in June 2015.

Professional Services

North East business tackling strain of more than 482,000 overdue invoices, research shows

Insolvency experts have warned of the growing strain overdue invoices are placing on North East businesses, with firms currently tackling almost half a million unpaid bills. The region’s firms have seen a 6.8% jump in unpaid bills in Q3 2024 compared to the same period in 2023, according to R3’s analysis of data provided by Creditsafe. In all, North East firms had 482,174 invoices that had gone past their payment deadline on their books in Q3 2024 – with 156,554 in July, 162,568 in August and 163,052 in September. The region faring the worst was the West Midlands, which has seen a 50.3% rise year-on-year, followed by Scotland on 33.6% and the South West on 12.1%. Kelly Jordan, chair of R3 in the North East, said: “While the rise in overdue invoices in the North East has been more modest compared to some other regions, it remains a warning sign of the financial strain many businesses in the region are still facing. Costs are continuing to rise, albeit at a slower pace, and it’s becoming increasingly more difficult to pass on these extra costs to customers or to cut back in other ways. “As a result, businesses are experiencing tighter margins and cash flow challenges, making it harder to keep up to date with the payments they owe.” The huge number of invoices were on the desks of more than 38,000 North East businesses in the third quarter of the year – with 12,615 firms in July, 12,771 in August, and 12,754 in September. This is 3.5% higher than the same period in 2023 which saw 36,843 North East businesses fail to pay their bills on time. Ms Jordan, who is a partner at Muckle LLP, added: “Although the number of companies with overdue invoices on their books fell slightly in September, the overall trend shows a consistent quarterly rise and numbers for that month are higher than in September 2023. These figures have been steadily increasing throughout the year and are significantly higher than they were last year. “Without a consistent improvement in payment practices or cash flow, many companies may find it increasingly difficult to manage their debt and maintain operations, and we could see more and more businesses turning to a formal insolvency solution as a result. “I would urge business owners and directors that are struggling to pay their bills on time to seek advice as soon as they can. Taking that first step can be hard, but by having the conversation early, you will have more time and more options available to you than if you’d waited for the problem to get worse.” Last month the Government announced the New Fair Payment Code – measures to support small businesses and the self-employed by tackling the scourge of late payments, which leads to 50,000 business closures a year according to the Federation of Small Businesses.